Croix, 26 September 2023 – To mark European Sustainable Development Week and the opening of WinWinWeeks 2023, Oney, a European bank specialising in consumer payment and financing, and the CSA Institute, are publishing the results of the European Barometer of Better Consumption, which this year focuses on the circular economy.

The report shows that in 2023, the European see the use of goods from the circular economy as more than a civic conviction, but rather as a new way of managing their budget more effectively. This keen interest, motivated by the search for the best price, will help to establish more responsible consumer behaviour, which can only take hold if retailers are attentive to three priority expectations: price, quality and sustainability.

66% of European people say they see the circular economy as a solution for better budget management

In Europe, where the issue of purchasing power is a major concern for households, the circular economy is first and foremost seen as a way of managing one’s budget more effectively, and even more so in the current economic climate.

While 31% of consumers have always seen the circular economy as a source of savings, 28% of new adopters are turning to this type of products for this reason. The search for a low price has therefore become the main motivation (59%) in 2023, ahead of the ecological motivation (31%). Lastly, 10% of French, 9% of Spanish and 7% of Portuguese people say they have no financial choice but to buy second-hand or refurbished products.

36% of buyers believe they have saved a lot by buying second-hand or refurbished products in the last year. This proportion is even higher for under-35s (44% in France, 43% in Spain).

If the Europen had to reduce their budget, 84% confirmed that they would prioritise the purchase of products from the circular economy.

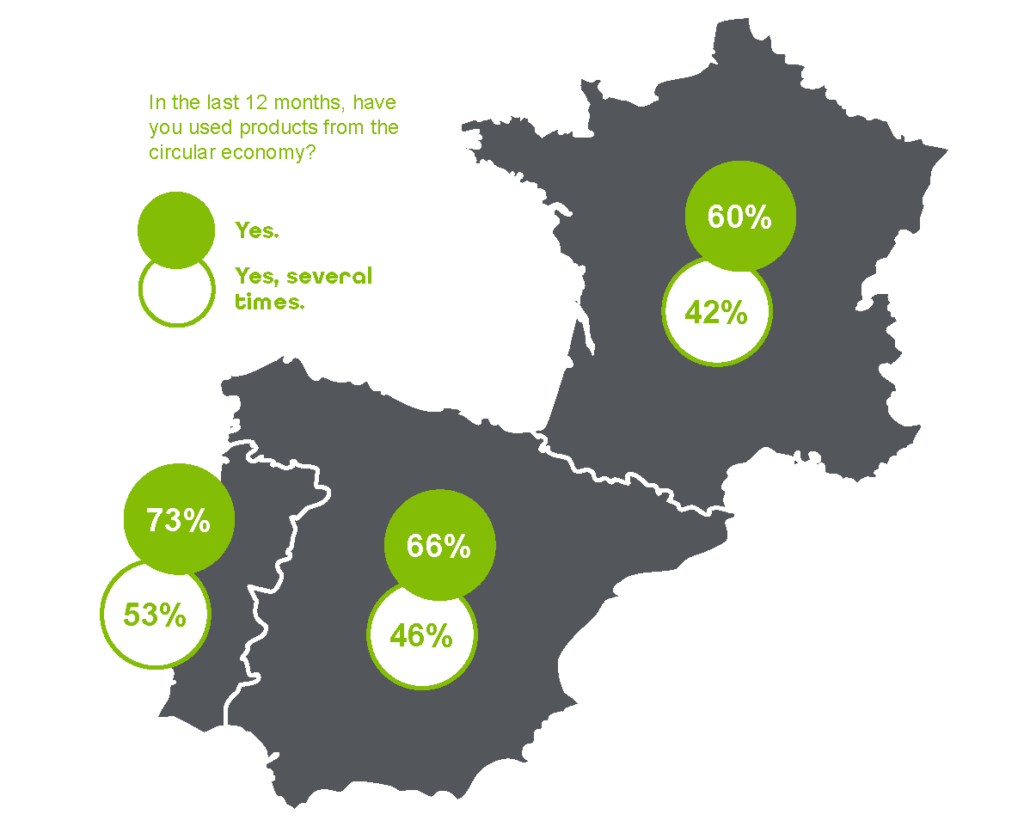

47% of European people buy second-hand products several times a year

In the last 12 months, 2 out of 3 European people (66%) have bought products from the circular economy. This is a practice that has become widespread and established, with 47% of the European even making this type of purchase several times a year.

While reducing consumption is a symbol of responsible consumption, the effort to avoid waste is actually the dominant motivation (66% in Europe, 10 points more than in 2022).

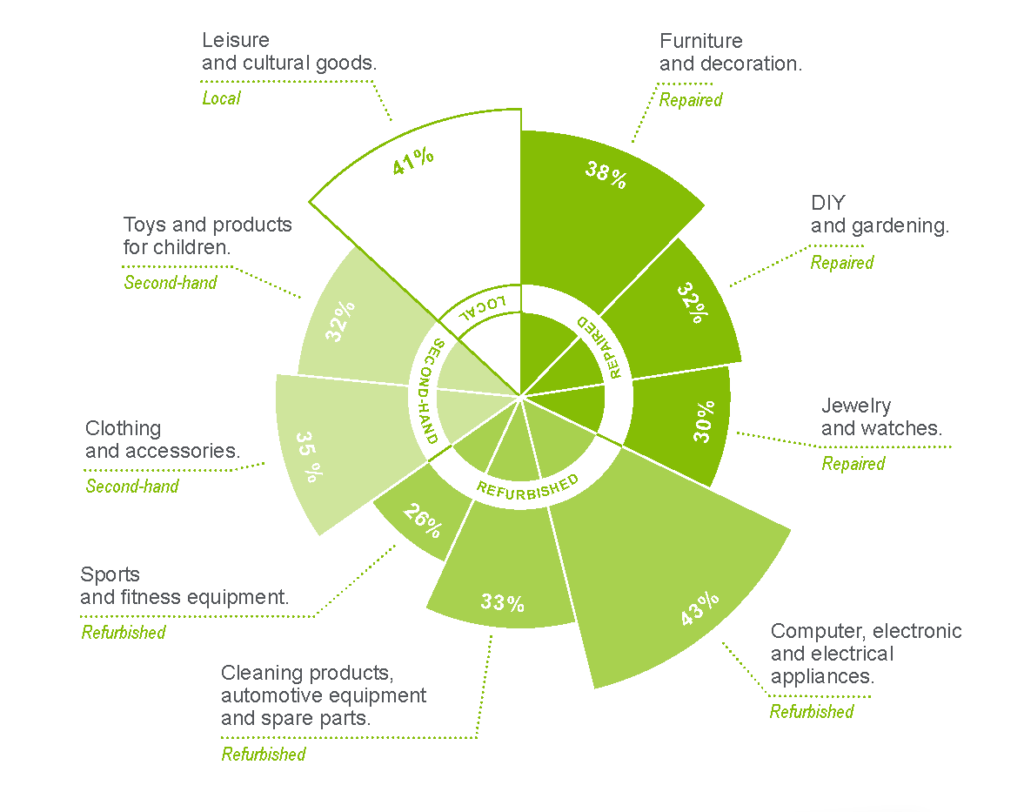

In this market, historically centred on second-hand clothing, new sectors are gaining momentum. In 2023, while 66% of European people say they have used the circular economy to buy clothes in recent months, consumers are also turning to five other promising sectors:

- Furniture and decoration (55%),

- Electrical and computer equipment (53%)

In this market, refurbishing and repair are emerging, particularly in the furniture and decoration, DIY and gardening sectors, as well as for high-tech products.

40% of European people feel that retailers’ level of involvement is very inadequate

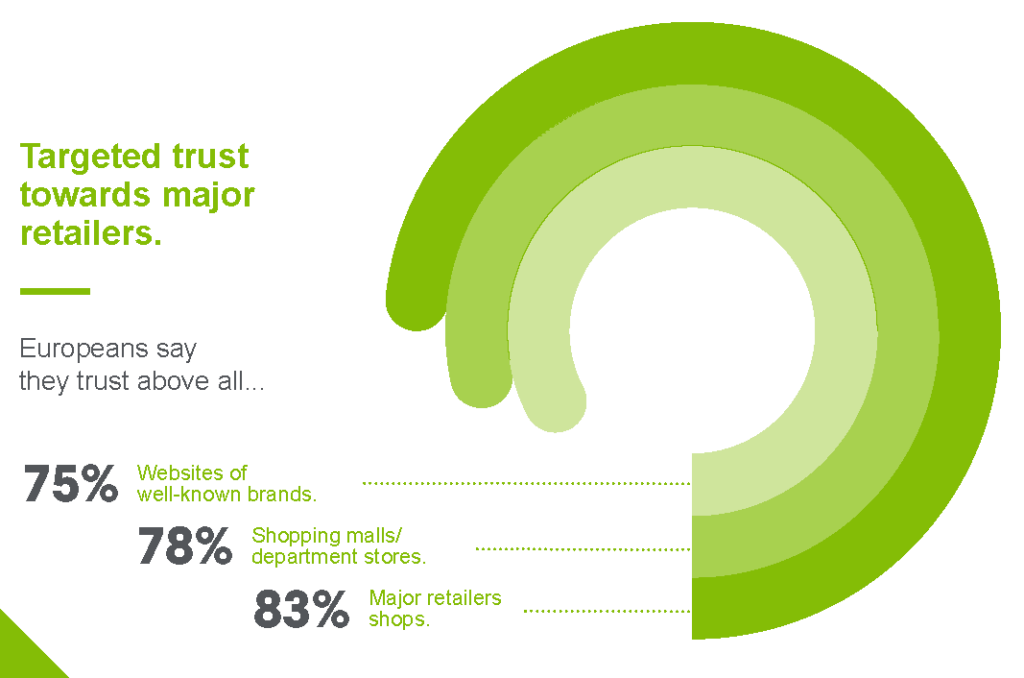

When consumers commit to this approach, they express high expectations of companies, particularly the major retailers, which enjoy the highest levels of trust (major retailer shops 83%; shopping centres and department stores 78%; website belonging to a major retailer 75%).

Fewer than 1 in 4 European people (24%) believe that retailers are sufficiently involved in the development of the circular economy.

To earn their trust, the French expect better information and reassurance:

- Information on the environmental impact of products: 50%

- Better showcasing in relation to new products: 49%

- Guarantees on products purchased: 46%

- Product traceability: 40%

Price, quality, sustainability: key drivers for developing the circular economy

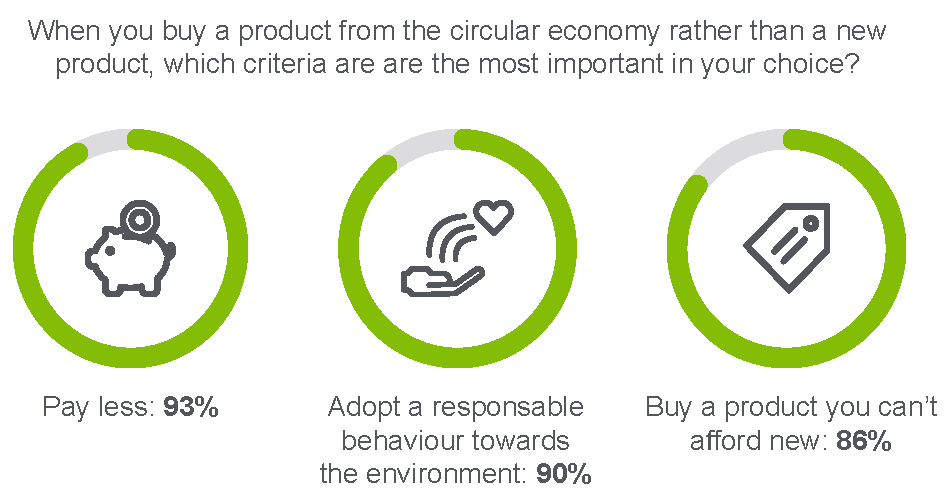

While 56% of European people still feel that the main obstacle to buying products from the circular economy is a price that is too close to new, the lack of confidence in the product’s lifespan (50%) and the lack of a guarantee of the product’s overall quality (48%) are the levers that will help to attract and retain consumers.

In 2023, price will remain the key to meeting consumer demands. 93% of French people say that “paying less for a product” is an important reason for not buying new products. However, 68% note that prices in the circular economy market have risen over the last 12 months, and 15% even say they have risen “a lot”.

Product sustainability is also a key lever. 63% of consumers would be prepared to pay more for a more sustainable product and 47% are prepared to pay between 5% and 10% more. The younger generations are clearly more committed to this issue, with 23% of French and 33% of Spanish under-35s prepared to pay 20% more for a more sustainable product.

Also, consumer finance services are a fundamental lever for developing the circular economy market and establishing more responsible consumption behaviour. 79% of consumers in the circular economy believe that they would be more encouraged to consume if payment in several instalments were offered by the retailer.

ABOUT ONEY

Oney is a different, unique bank, born of commerce. A partner in the transformation of commerce for 40 years, Oney develops innovative payment, financing and insurance solutions to give everyone the power to improve their daily lives and consume better. Oney created split payments in 2008 and is the market leader in BNPL (Buy Now Pay Later) in several European countries. Alongside 4,400 merchant and e-merchant partners in nearly 16,000 physical or online points of sale, Oney supports the projects of 7.8 million customers in Europe by offering them simple and fast digital purchasing experiences. Every day, our 2,600 talents, in 12 countries, drive the ambition to be a more human and responsible bank. [3]

With the support of its two shareholders, BPCE (50.1%) and ELO (ex-Auchan Holding, 49.9%), Oney brings together the best of banking and commerce. Within Groupe BPCE, Oney is part of BPCE Digital & Payments, a new pole combining payment, digital and data expertise.

[3] Data measured in 2022, December 31st