Croix, April 5th 2022 – How are Europeans managing their budgets at the start of this year? What levers can be used to optimise it? To find out, Oney, the consumer payment and financing expert and leader in split payments in several European countries, surveyed a representative sample of French, Spanish and Portuguese populations, in partnership with Harris Interactive.

This study reveals the common fears of Europeans in the current economic and international climate, which is increasing their tendency to be more attentive to their budget, to look for ways to make savings and to adopt a prudent and opportunistic attitude in 2022. Budget management is becoming a priority and split payments (BNPL or Buy Now Pay Later), now firmly established in consumer habits, are increasing in popularity as a tool for supporting consumption and managing personal budgets.

- 38% of Europeans believe that their purchasing power has decreased over the past year

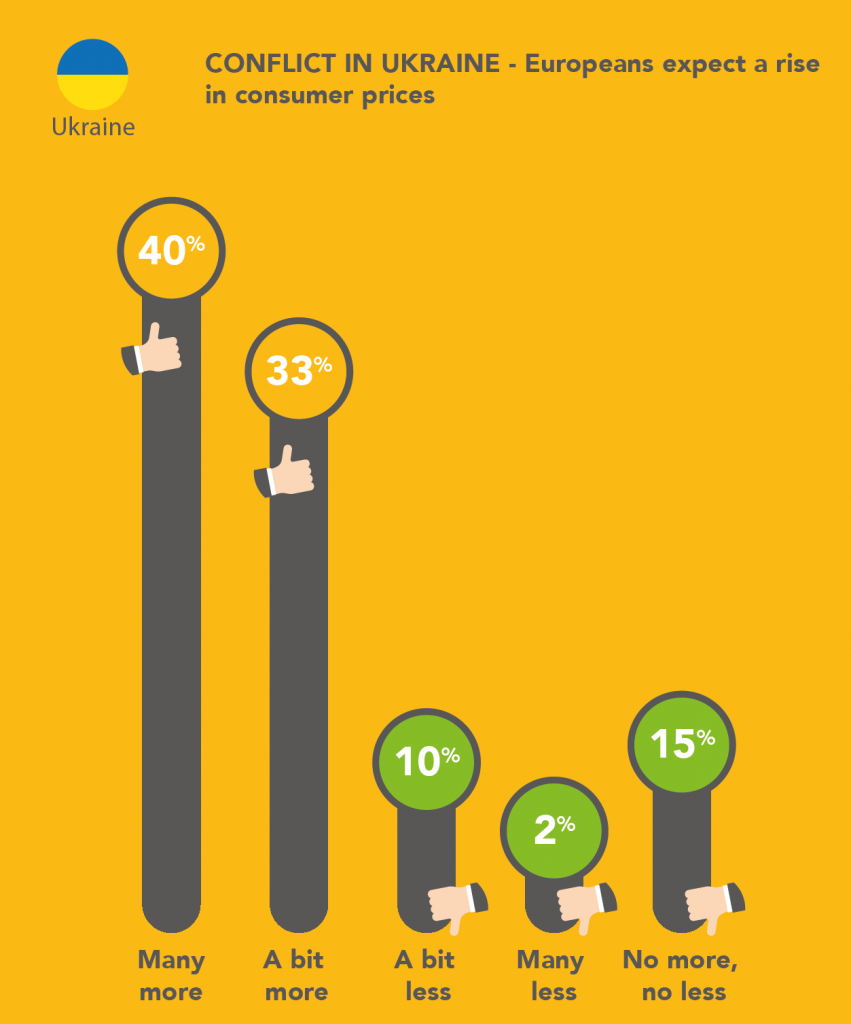

- 73% believe that the conflict in Ukraine will affect their ability to consume

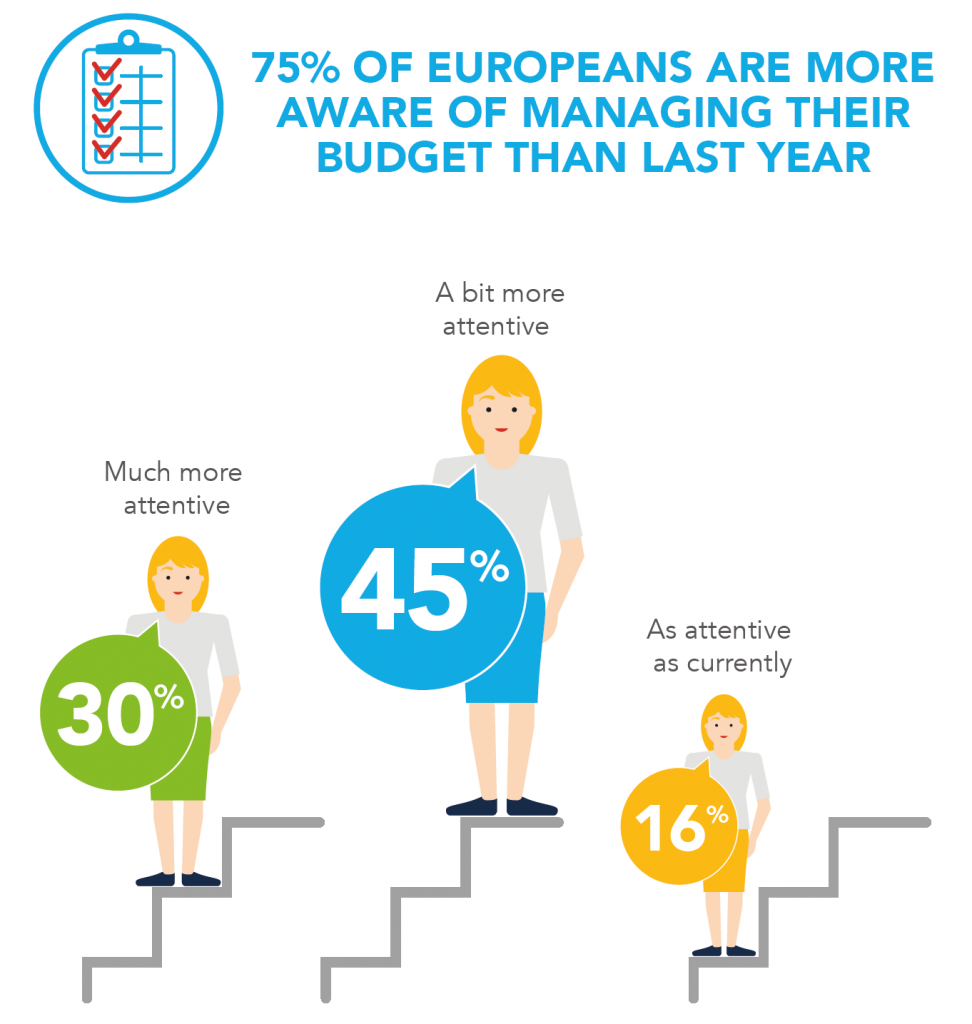

- 75% are more attentive with their budgeting than last year

- Half of all users of split payments are expecting to use them more often in 2022

- 75% of those surveyed believe that paying in instalments allows them to continue to purchase without going overdrawn

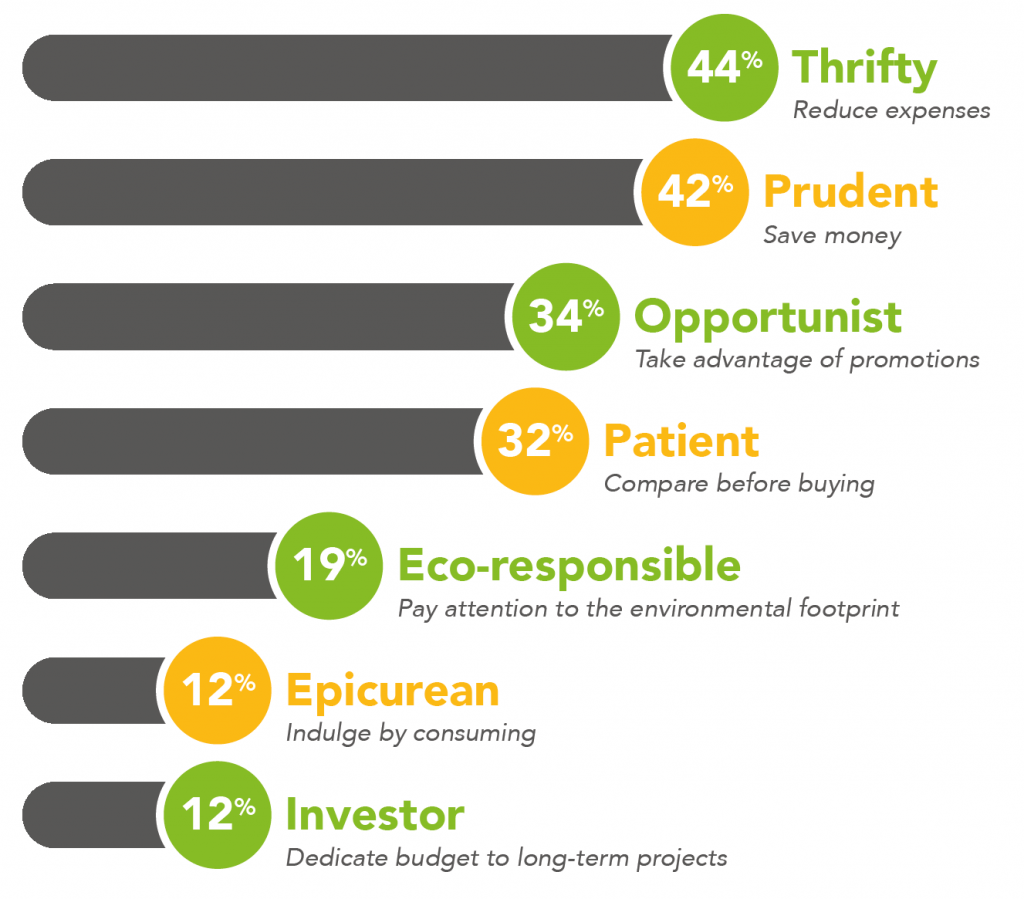

44% of Europeans will be thrifty in 2022

At the beginning of this year, consumers in all three countries surveyed share a similar opinion: their purchasing power will not increase this year.

Indeed, more than a third of them (38%) think that it will be “weaker” than last year, a feeling expressed more by the French (44%; +10 points vs. 2021). Consumers in the three countries surveyed are even anticipating a reduction in their spending over the coming months: 44% define themselves as “thrifty”.

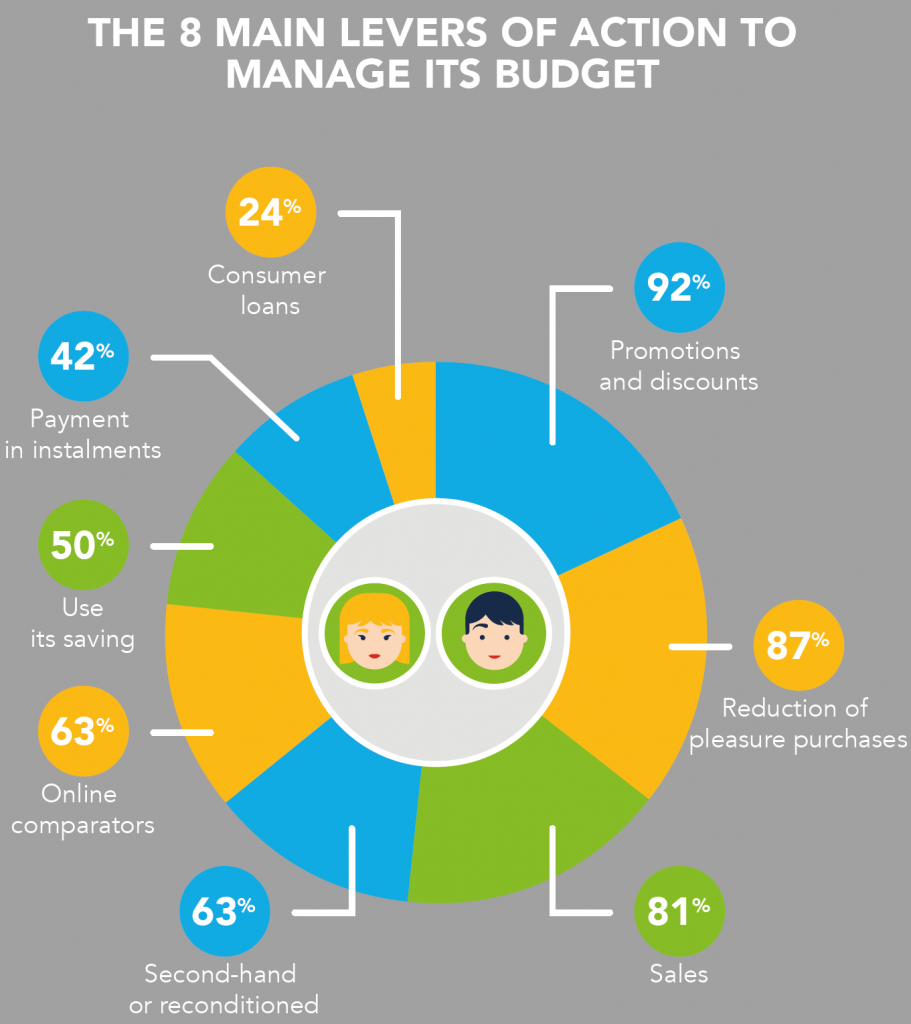

This trend is reflected in the behaviour of respondents: overall, 92% of them say they will look for more discounts and promotions, while 87% plan to cut back on “pleasure” purchases.

The Russian-Ukrainian conflict seems to be intensifying this savings trend: almost three quarters (73%) fear that the share of their budget allocated to consumer spending* is set to increase over the coming months, as they expect inflation to raise the prices of consumer goods.

Budgeting has become a priority for Europeans

Although 75% of respondents in the three countries say they have been more attentive with budgeting over the past 12 months, 40% of Europeans still say they regularly face overdrafts at the end of the month, 12% of them every month, mostly for an amount of €200 or less.

To cope with this, consumers are looking to new solutions. 63% of Europeans say that buying second-hand or reconditioned products or using online price comparator are new ways of controlling their budget.

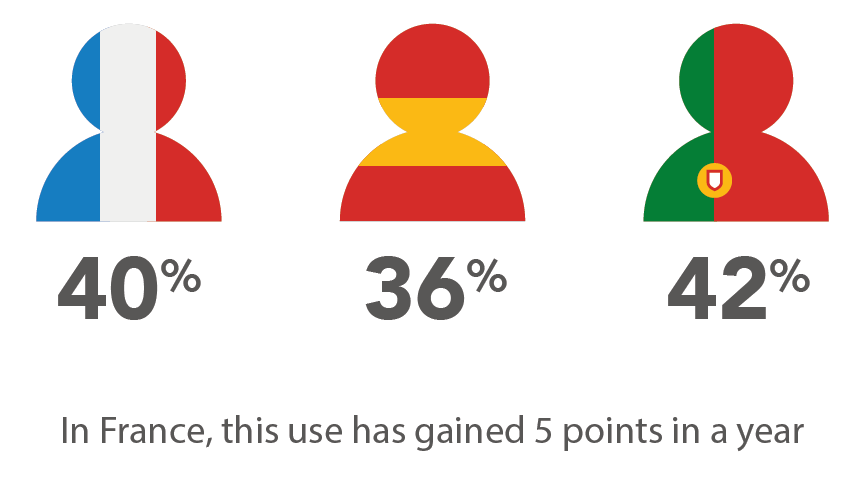

Payment in instalments is also becoming a popular way of gaining budgetary control, for 42% of consumers in 3 European countries: 49% in France, 42% in Spain and 36% in Portugal.

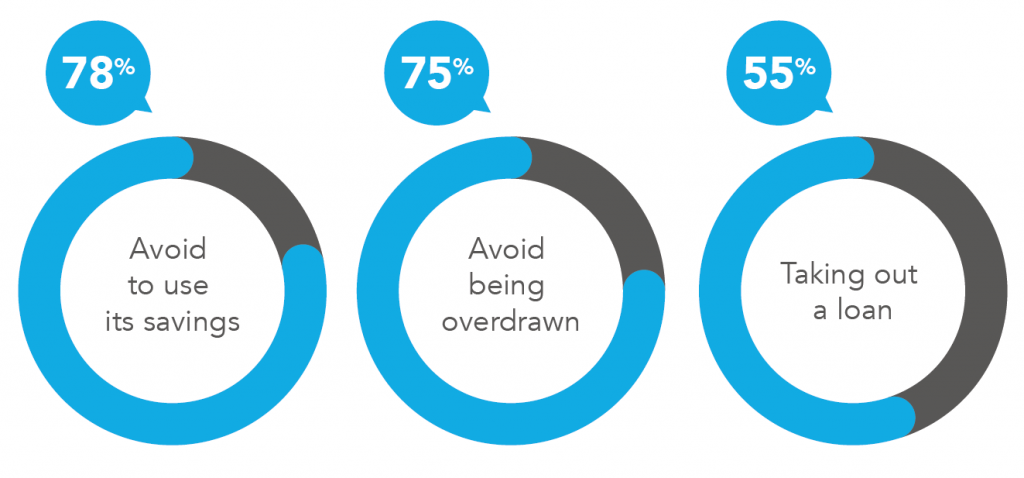

Moreover, 78% say they use split payments to avoid tapping into their savings, and 75% to avoid going overdrawn.

Finally, the study confirms that consumers are attracted by how easy it is to use split payments: 55% use them to avoid having to take out a loan.

Split payments (Buy Now Pay Later), already well established as part of consumer habits, is expected to increase in 2022 as consumers seek to control their budgets

Split payments have now become a regularly used payment facility: 39% of respondents claim to have used them in 2021, either online or in store.

In Europe, half of all consumers have made more use of split payments in 2022 to make purchases.

Split payments are particularly popular in France, where 85% of consumers who paid in three or four instalments in 2021 intend to use them again in 2022, and 51% of them expect to resort to this payment method more often than in 2021. Split payments of between 5 to 12 instalments are also expected to increase: 73% of Europeans intend to reuse them in 2022.

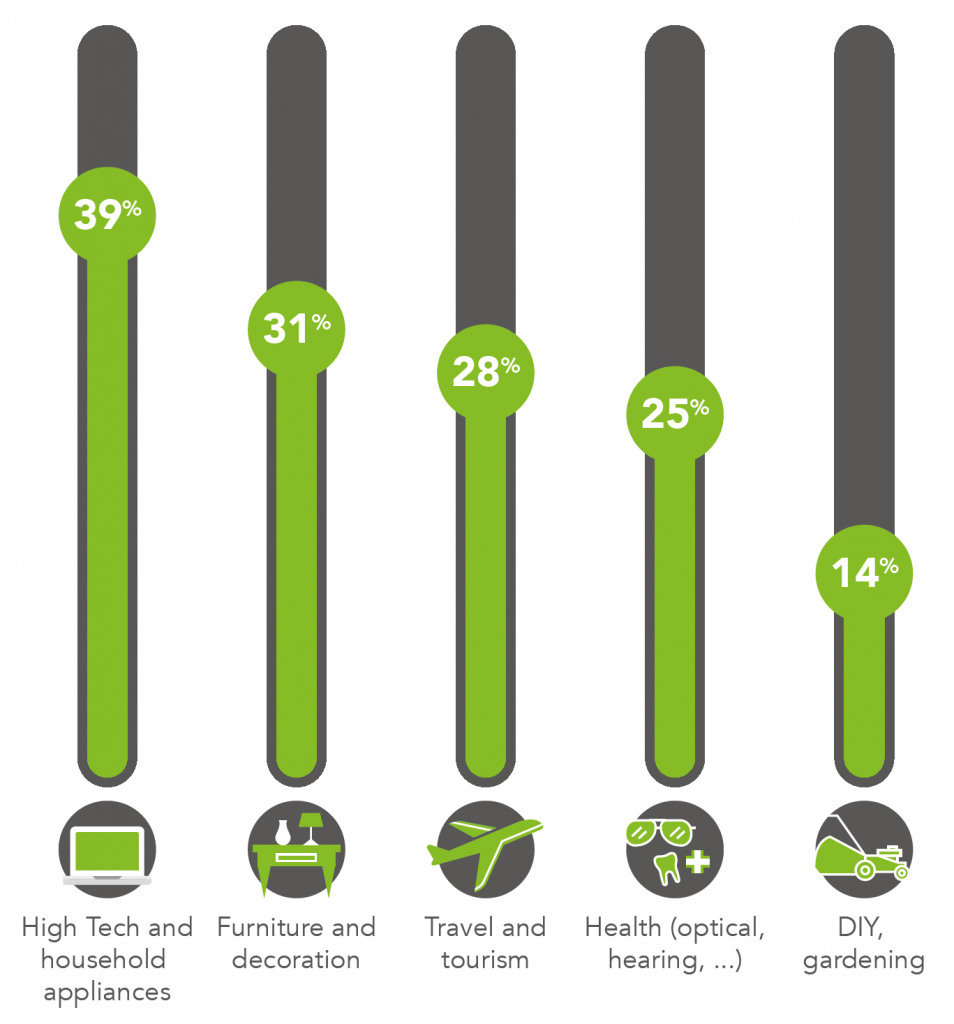

Purchases related to home improvements will account for a large proportion of split payments over the coming months. Travel and health will be among the top 5 purchases made in 2022 using instalments by credit card.

Among users,

- 68% use them primarily for “one-off” purchases (supplies, specific appliances such as computers, etc.)

- 46% to finance projects (travel, home renovations, health equipment, etc.)

- and 24% for “pleasure purchases” (gifts, clothing, etc.)

80% use them several times per year (+4% compared to the previous year). This upward trend can be explained by a change in perception: BNPL is now seen as a payment facility that allows access to higher quality – and therefore more sustainable- goods (63%), whilst also avoiding a negative impact on personal savings or being overdrawn (76%) when making an unexpected or emergency purchase.

While split payments are also available in bricks-and-mortar stores, their use is even more frequent online, with 57% of consumers planning to use them in this context.

This is due to a persistent misconception among Europeans that this solution is not available in physical stores, although 43% of respondents would like to use it in such outlets. Another misconception is that BNPL is only offered by “big brands” and not by smaller retailers. In fact, 71% of respondents said they would use the BNPL at large retailers (online and physical).

Oney, the leader in fractional payments, is ready to meet these challenges in 2022

Creator of the first split payment solution by bank card 14 years ago, and leader in France and in several other European countries, Oney has adapted its solutions to all areas of consumption, in all types of sales outlets and across all sales channels.

The 3x 4x Oney solution is now available for local stores through the Caisse d’Epargne and Banque Populaire high-street banks. In March 2022, Oney also announced a partnership with Payplug and Prestashop to enable the 136 000 European e-retailers using this platform to access a 3x 4x payment solution directly via the Prestashop platform.

| Methodology Harris Interactive survey for Oney, conducted online from 9 to 14 March 2022, among three representative samples of the national population aged 18 and over in France, Spain and Portugal. Quota method and adjustment applied to the following variables: gender, age, income level and region of residence of the interviewee. |

About Oney

We are a commercial bank that is different and unique. We rely on our original positioning and the expertise we have gained over 38 years to design innovative payment solutions and financial services. Every day, our 2,600 talented people around the world are reinventing the bank, forging a more human relationship, with the mission of “Enabling everyone to improve their daily lives and consume better”. With our 13,000 in-store retailer and e-retailer partners, we are supporting the realisation of projects for more than 7.8 million customers in 12 European countries by offering them memorable shopping experiences both in-store and online. Since 2019, we have two shareholders: BPCE (50.1%) and Auchan Holding (49.9%), bringing together the best of banking and retail. Within the BPCE Group, Oney is part of BPCE Digital & Payments, a new division combining payment, digital and data expertise.

Oney Press contacts

Oney – Frédéric Tancrez: ftancrez@oney.fr / +33 (0)7 60 88 55 03